Christophe Barraud forecasts economic growth after the 2024 election, presenting three scenarios based on the outcome.

Discover more from

Subscribe to get the latest posts sent to your email.

Christophe Barraud, with a strong track record of forecasting and known as the world’s most accurate economist, is turning his attention to the upcoming 2024 election and its potential economic impact. He anticipates that growth will pick up once the election results are in, as companies shake off uncertainty and start making decisions again.

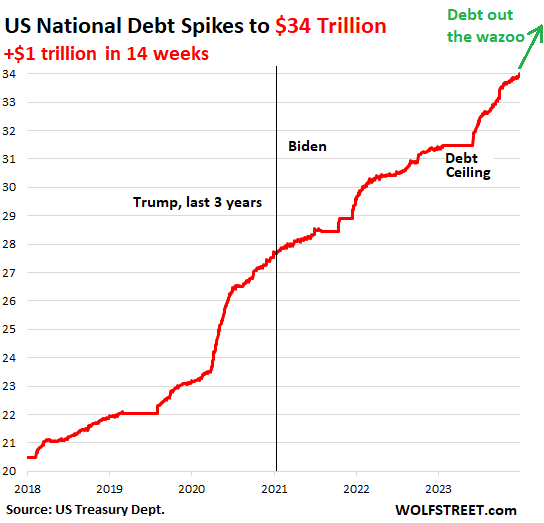

But while he’s positive about GDP numbers surpassing expectations, he also warns of potential pitfalls, especially if Trump’s tax cuts lead to ballooning deficits. With a history of nailing forecasts, he now faces the most asked question: will it be Trump or Harris in the White House?

The Bloomberg favourite, chief economist and strategist at Market Securities Monaco, the top U.S. forecaster presented three scenarios to Business Insider that might take place after the presidential win.

In the first scenario, if Vice President Kamala Harris wins but Congress is split, there won’t be much change for the economy. Things are likely to stay the same. Since Harris is currently serving as Vice President in Joe Biden’s administration with her talks largely focused on strengthening the ongoing policies, the claim made just fits right into the situation.

In the second scenario, if former President Donald Trump wins but Congress is divided, he won’t be able to easily cut taxes for businesses and individuals. In that case, chances are high he will turn his focus to foreign policy, leading to quicker trade restrictions and tariffs, which could harm global growth. In the short term, this situation would keep the U.S. GDP stable, but it could hurt the economy long-term as other countries respond, according to the BI report.

The third scenario predicts a Trump win with a Republican majority, which is seen as the most likely outcome. If this goes down, Trump might cut taxes for people and companies and pay more attention to issues happening in the U.S. Right now, this could help the U.S. economy grow faster, maybe by 2.1% to 2.3% in 2025, he suggested.

During the talk, Barraud shared insights from his high-profile tech clients, including large banks and hedge funds, regarding their concerns over the growing U.S. deficit, especially if Trump is elected and implements tax cuts. Currently, major corporations have held back on their big decisions due to uncertainty about who will win the razor-thin margin election which can sway in any direction and is affecting economic growth.

While he claimed that the GDP will make a strong comeback, he also addressed worries about what could happen if Trump is elected and enacts tax cuts. These cuts could lead to a decline in government revenue, raising questions about how high the deficit might rise and what it could mean for the 10-year Treasury yield.

Subscribe to get the latest posts sent to your email.

Subscribe now to keep reading and get access to the full archive.