Bajaj Auto Share Price Today: Key Insights and Market Trends

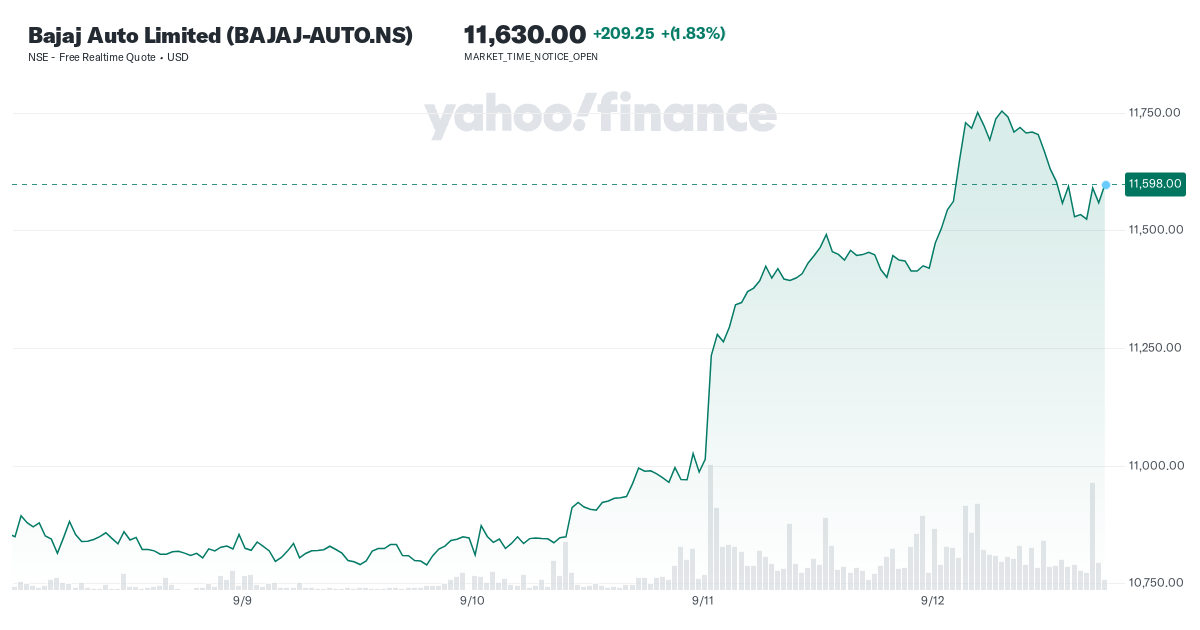

As of September 12, 2024, Bajaj Auto Ltd. is trading at ₹11,570.45, reflecting a notable increase of approximately 2.54% from the previous trading session. This article provides an overview of the current share price, recent performance trends, and insights into the factors influencing Bajaj Auto’s stock in the competitive automotive market.

Current Market Performance

Bajaj Auto’s stock has shown impressive resilience, recently achieving a 52-week high of ₹11,499.00. The share price has experienced significant growth over the past year, with a remarkable return of approximately 130.48%. Over the last three months, the stock has delivered an impressive return of 16.39%, indicating strong investor confidence and positive market sentiment.

- Previous Close: ₹11,420.75

- Day’s Range: ₹11,420.75 – ₹11,710.00

- Market Capitalization: ₹305,312 crore

- P/E Ratio: 37.91

- Dividend Yield: 0.74%

Recent Developments

Bajaj Auto has been actively expanding its product offerings, particularly in the electric vehicle (EV) segment. The company recently received orders for 6,000 units of its newly launched CNG motorbike, the Bajaj Freedom, which highlights its commitment to diversifying its portfolio and meeting evolving consumer demands. This strategic move aligns with the growing trend towards sustainable transportation solutions.

Financial Highlights

Bajaj Auto has demonstrated strong financial performance, characterized by consistent growth in revenue and profitability. Key financial metrics include:

- Revenue Growth: Annual revenue growth of 23.02%, outperforming its three-year CAGR of 16.68%.

- Return on Equity (ROE): Currently stands at 17%, reflecting efficient management and strong profitability.

- Debt to Equity Ratio: 0.01, indicating a solid balance sheet with minimal debt.

Analyst Insights

Analysts remain optimistic about Bajaj Auto’s growth prospects, citing its robust order book and expanding market presence. The company’s ability to adapt to market dynamics and invest in innovation positions it favorably in the competitive automotive sector. Current recommendations from analysts suggest a “Hold” position, reflecting confidence in the company’s long-term potential while acknowledging short-term market fluctuations.

Conclusion

Bajaj Auto’s share price today reflects a robust performance amidst a competitive landscape. With strong financial fundamentals, strategic initiatives in the EV segment, and positive market sentiment, the company is well-positioned for continued growth. Investors should keep an eye on upcoming quarterly results and market developments to make informed decisions regarding their investments in Bajaj Auto. The company’s commitment to innovation and sustainability will likely play a crucial role in its future success in the automotive market.

Discover more from

Subscribe to get the latest posts sent to your email.