Brokerages expect Wipro to perform better than its guided range of -1 percent to +1 percent, when the company reports its September quarter earnings on October 17

The Street will closely monitor Wipro’s revenue guidance and commentary on the demand environment when the information technology major reports its earnings for the second quarter late this week.

Brokerages expect the Bengaluru-headquartered firm to perform better than its guided range of -1 percent to +1 percent when its reports its second quarter earnings on October 17.

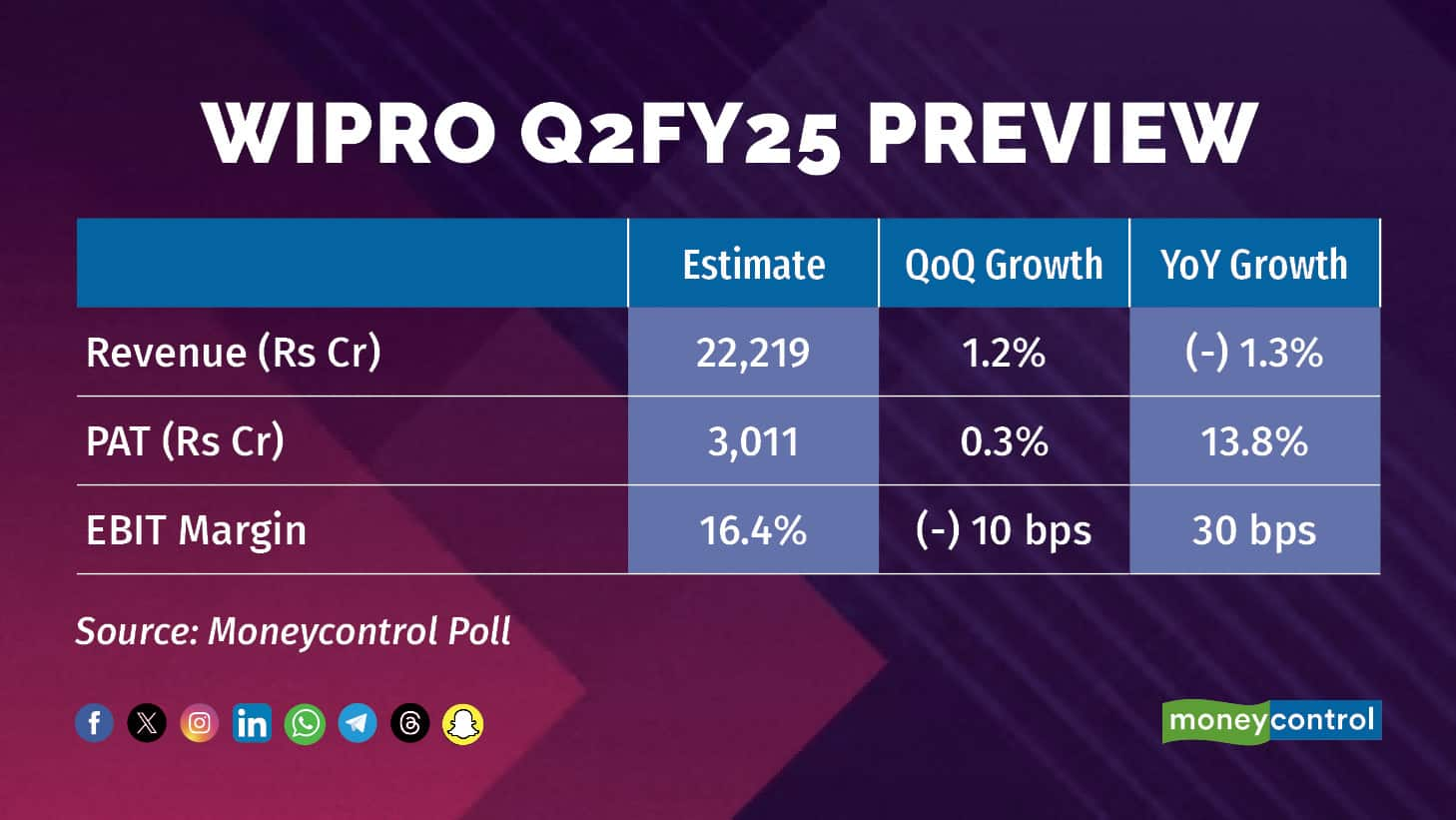

Wipro is expected to clock a sequential revenue growth of around 1.2 percent, gaining from new deal ramp-ups, brokerages said in their pre-earnings note.

Analysts will also await an update on the company’s new five focus areas, as laid out by chief executive officer Srinivas Pallia. Progress on acceleration of large-deal momentum, strengthening existing relationships, industry-specific offerings and solutions, AI-ready talent and simplifying the operating model would be something to watch.

Here are the top five themes likely to play out in Q2:

Revenue guidance

Wipro’s revenue guidance for the third quarter is much anticipated to gauge how the company expects to do in the October-December at a time when the demand environment is weak.

Brokerages expect the IT major to give a guidance range of -0.5 percent to +1.5 percent.

For context, Wipro’s cross-city rival Infosys revenue guidance for the financial year 2024-25 in July 18 is in the range of 3-4 percent.

The IT industry, which has previously seen double-digit growth, is going through a lean phase as a result of a weak macroeconomic situation, which, in turn, has led clients to cut down their spending.

“We expect Wipro to guide for -1 percent to +1 percent QoQ CC (constant currency) for 3QFY25 suggesting continued demand weakness even in 3QFY25,” brokerage firm Jefferies said in a note.

JM Financial believes that Wipro’s anticipated weak Q3 guidance could confirm that a softer second fiscal half remains unchanged.

Consulting business

In July, Pallia was confident that Wipro’s subsidiary Capco, which is in the consulting business, will continue to perform well in Q3. He said Capco has been doing well both on the bookings and revenue front, with over 3 percent sequential growth.

Rizing, another subsidiary of Wipro in the consulting space, performed well in Q1 with large transformation deal wins. “Clients are looking us as sort of bringing the consulting capabilities of Rizing along with the delivery and execution capabilities of Wipro together, and that’s where we are able to win some of the transformation deals,” Pallia said.

Analysts would keep an eye on this part of the business.

Kotak Institutional Equities said investor focus would be on the sustenance of green shoots in the consulting business, especially from Capco and Rizing subsidiaries as well as on positioning in cost takeout and vendor consolidation deals where Wipro can be vulnerable.

Brokerage Motilal Oswal Financial Services expects the Capco subsidiary to well, as the demand environment likely improved in the key market of the US, particularly in banking and financial services.

“Commentary on recovery in the consulting business as well as strategic initiatives from the new management will be the key monitorables,” the brokerage’s analysts Abhishek Pathak and Keval Bhagat wrote in a pre-earnings note.

Demand environment

Wipro’s commentary on the demand environment would be watched, as various brokerages assess whether interest rate cuts by the US Federal Reserve have had any bearing.

Though there are signs of demand stabilisation, particularly in sectors like BFSI and manufacturing, the overall outlook remains uncertain, they said, cautioning that prolonged decision-making cycles could impact Wipro’s revenue growth.

“In Q1, we did not see a significant shift in the demand environment. Clients remain cautious and our discretionary spending continues to be muted,” Pallia said in July. It remains to be seen whether the demand scenario has changed for the good.

Tata Consultancy Services (TCS) echoed the same sentiments as Wipro but India’s largest IT service’s player said the BFSI sector is recovering in its key markets.

“We expect growth in BFSI (especially US) to offset by sustained weakness in E&U (energy and utilities vertical),” said JM Financial.

Also read: TCS margins decline amid higher third-party costs as BSNL project peaks

Deal ramp-up

Deal ramp-up would be a crucial factor in Q2, analysts also said. New deal ramp-up indicates a pick-up in demand.

Brokerages said industries such as BFSI, manufacturing, telecom, retail, and hi-tech are expected to show some recovery, with new deal ramp-ups contributing to a growth momentum.

“The management commentary on new deal ramp-up and visibility going ahead is a key thing to watch,” Axis Securities said.

Nonetheless, a telco deal that Wipro won in Q1 would be staggered between the second and the third quarters. Chief financial officer Aparna Iyer said these deals typically take some time to ramp up and take a few quarters to realise its full revenue potential.

Wage-hike impact

Wipro’s wage hike decisions are expected to influence its operating margin in the second quarter.

Several major IT companies shifted wage hikes to the third quarter to manage costs and sustain profitability amid a sluggish demand environment.

Apart from Wipro, companies such as Infosys, HCLTech, LTIMindtree and L&T Tech Services went ahead with this decision, recent brokerage reports and analysts said.

Also read: Infosys, HCLTech, & LTIMindtree shift wage hikes to Q3

Axis Securities projects a marginal contraction of around 28 basis points (bps) in operating margins. JM Financial said it built in one-month of wage hike, effective September 1. However, even after the impact, the brokerage expects Wipro to post a 40 bps increase in margins to 16.8 percent for the quarter.

Nomura said margins might expand 40 bps despite the one-month impact of salary hikes, led by the continued cost control program and higher utilisation at Capco.

One basis point is one-hundredth of a percentage point.

On October 14, the Wipro stock was trading at Rs 548.9 on the National Stock Exchange (NSE), up 3.9 percent from the previous close.

Discover more from

Subscribe to get the latest posts sent to your email.