Tata Power Stock Analysis: What’s Driving the Price to ₹482.60?

As of October 1, 2024, Tata Power shares are trading at ₹482.60, reflecting a robust performance amid significant market developments. This article delves into the factors driving the stock’s current price and provides insights into its future potential.

Recent Performance Overview

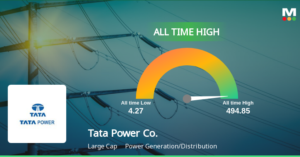

Tata Power has seen impressive growth, with its stock recently reaching a 52-week high of ₹494.85 on September 27, 2024. The share price has appreciated by approximately 84% over the past year, showcasing strong investor confidence and market support.

- Current Price: ₹482.60

- 52-Week Range: ₹230.75 (low) – ₹494.85 (high)

- Market Capitalization: ₹1.54 lakh crore

Key Drivers Behind the Price Surge

- Strategic Partnerships:

- Tata Power recently signed a Memorandum of Understanding (MoU) with the Rajasthan government for a comprehensive 10-year plan worth nearly ₹1.2 lakh crore. This initiative aims to enhance power distribution, transmission, and renewable energy projects across the state, positioning Rajasthan as a leader in India’s clean energy transition.

- Strong Financial Performance:

- The company reported an operating revenue of ₹63,529.23 crore on a trailing 12-month basis, with an annual revenue growth of 12%. Despite facing challenges, Tata Power’s pre-tax margin stands at 7%, and its return on equity (ROE) is approximately 11%, indicating solid operational efficiency.

- Technical Indicators:

- From a technical standpoint, Tata Power is trading above its key moving averages, suggesting bullish momentum. The stock has recently broken out from a base in its weekly chart and is comfortably positioned around its pivot point, which is seen as an ideal buying range.

- Growing Demand for Renewable Energy:

- As part of its commitment to sustainability, Tata Power aims to increase its renewable energy capacity significantly. The company plans to achieve a renewable production target of 15 GW by 2025, with current renewable sources accounting for about 30% of its total capacity.

Analyst Insights

Analysts remain optimistic about Tata Power’s long-term prospects but advise caution due to its high debt-to-equity ratio of 116%, which could pose risks if not managed effectively. The stock currently has an EPS Rank of 73, indicating fair earnings performance but highlighting the need for improvement.

- Resistance Levels: Analysts have identified key resistance levels at approximately ₹472.53, ₹476.97, and ₹483.03.

- Support Levels: Initial support is seen around ₹462.03, indicating potential price stability in case of market fluctuations.

Market Sentiment

The overall sentiment surrounding Tata Power remains positive, bolstered by institutional interest and recent strategic developments. The stock’s relative strength index (RSI) stands at around 75.7, indicating that it may be approaching overbought territory; however, this also reflects strong demand from investors.

Conclusion

Tata Power’s share price at ₹482.60 is supported by strategic partnerships, strong financial performance, and a commitment to renewable energy growth. While there are concerns regarding its debt levels and market volatility, the company’s proactive approach to expanding its renewable energy portfolio positions it well for future growth.Investors should continue to monitor market trends and company developments as they consider their investment strategies in Tata Power, particularly given its ambitious plans and the evolving energy landscape in India.

Discover more from

Subscribe to get the latest posts sent to your email.