PNG Jewellers IPO Allotment Status: Check Your Shares as the Allotment Date Arrives

The excitement surrounding the PNG Jewellers IPO is palpable as investors eagerly await the allotment status. The IPO, which opened for subscription from September 10 to September 12, 2024, has garnered significant interest, closing with an impressive subscription rate of 59.41 times. This article provides essential details on how to check your allotment status and what to expect in the coming days.

Key Details of the PNG Jewellers IPO

- IPO Opening Date: September 10, 2024

- IPO Closing Date: September 12, 2024

- Allotment Date: September 13, 2024

- Listing Date: September 17, 2024

- Price Band: ₹456 to ₹480 per share

- Lot Size: 31 shares

- Total IPO Size: ₹1,100 crore

The IPO was well-received, with a robust response from various investor categories, including Qualified Institutional Buyers (QIBs), Non-Institutional Investors (NIIs), and Retail Investors. The QIB segment alone was subscribed 136.85 times, while the NII and retail portions were subscribed 56.09 times and 16.58 times, respectively.

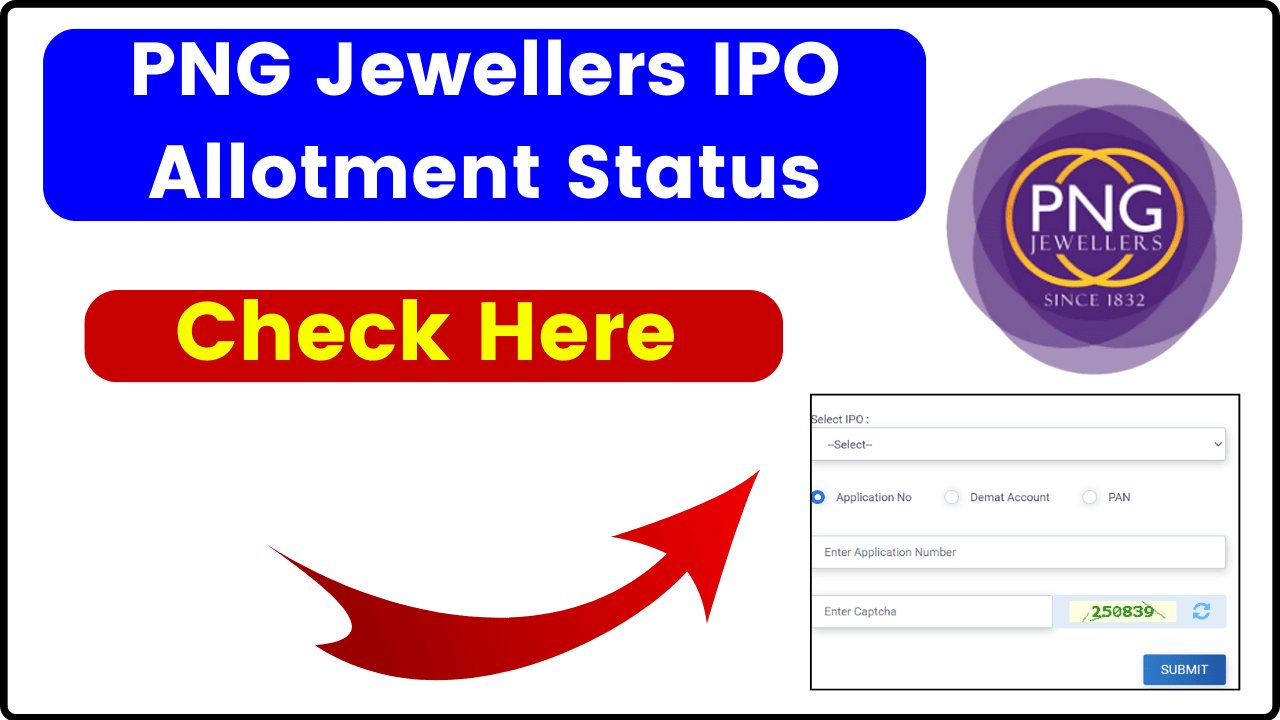

How to Check Your Allotment Status

Investors can check the allotment status of the PNG Jewellers IPO through the following methods:

1. Bigshare Services Website

Bigshare Services Pvt Ltd is the official registrar for the PNG Jewellers IPO. To check your allotment status:

- Visit the Bigshare Services IPO Allotment page.

- Select P N Gadgil Jewellers from the dropdown menu.

- Choose your application type: Application Number, Beneficiary ID, or PAN ID.

- Enter the required details and the captcha code.

- Click on the Search button to view your allotment status.

2. BSE Website

You can also check the allotment status on the Bombay Stock Exchange (BSE) website:

- Go to the BSE Application Status page.

- Select Equity under the issue type.

- Choose P N Gadgil Limited from the dropdown menu.

- Enter your application number and PAN ID.

- Complete the captcha verification and click Submit.

What Happens Next?

After the allotment process, successful applicants will receive notifications regarding the debit of funds or revocation of their IPO mandates. The shares are expected to be credited to the Demat accounts of successful applicants by September 14, 2024, ahead of the expected listing on the stock exchanges on September 17, 2024.

Grey Market Premium (GMP)

As of the latest updates, the grey market premium (GMP) for PNG Jewellers shares is reported to be around ₹255, indicating a strong potential listing gain for investors. This premium reflects positive market sentiment and investor confidence in the company’s growth prospects.

Conclusion

The PNG Jewellers IPO has generated significant interest among investors, and the allotment status is now available for checking. With the allotment date set for September 13, 2024, investors are encouraged to follow the outlined steps to confirm their share allocation. As the listing date approaches, all eyes will be on PNG Jewellers as it prepares to make its debut on the stock exchanges, promising exciting opportunities for both the company and its investors.

Discover more from

Subscribe to get the latest posts sent to your email.