“IEX Stock Update: Key Metrics and What’s Driving Growth in the Energy Sector”

Indian Energy Exchange (IEX) Share Price Overview

The Indian Energy Exchange (IEX) has been a significant player in India’s electricity trading market since its establishment in 2007. The exchange facilitates the trading of electricity through an electronic platform, allowing for efficient transactions between buyers and sellers. As of September 24, 2024, IEX’s share price has seen notable fluctuations influenced by market conditions and regulatory developments.

Current Share Price and Market Performance

- Current Price: ₹216.88 (as of September 24, 2024), down from ₹239.25 previously, marking a decline of approximately 9% on reports of potential market coupling implementation by the government.

- 52-Week Range: The stock has varied between a low of ₹121.35 and a high of ₹230.29 over the past year.

- Market Capitalization: Approximately ₹19,534 crore, reflecting its substantial presence in the energy sector.

| Metric | Value |

|---|---|

| P/E Ratio | 53.85 |

| EPS (TTM) | ₹4.17 |

| Dividend Yield | 1.11% |

| Book Value | ₹10.90 |

| Debt to Equity Ratio | 0.01 |

| Return on Equity (ROE) | 36.08% |

IEX has demonstrated strong financial health with no debt over the past five years and a consistent return on equity, which was recorded at 36.08% for the financial year ending March 2024.

Recent Developments Impacting Share Price

- Market Coupling Concerns: The recent drop in share price is primarily attributed to news regarding the government’s plans to implement market coupling by FY25. This system aims to unify electricity pricing across various exchanges, potentially impacting IEX’s market dominance, which currently holds around 84% of the power trading business in India.

- Profitability Reports: Despite the recent downturn, IEX reported a consolidated net profit increase of over 27%, reaching ₹96.44 crore for the June quarter of 2024, compared to ₹75.82 crore in the same period last year.

- Stock Performance Trends: Historically, IEX shares have shown volatility, with only 1.75% of trading sessions in the last six years recording intraday gains exceeding 5%.

Future Outlook

Analysts have varied predictions for IEX’s share price targets over the coming years:

- 2025 Target Prices:

- January: ₹210

- June: ₹197

- December: ₹375 (projected high) .

The ongoing discussions regarding market coupling and its implications will be critical to watch as they could reshape IEX’s operational landscape significantly.

What are the key factors driving IEX’s revenue growth

Key Factors Driving Revenue Growth for Indian Energy Exchange (IEX)

The Indian Energy Exchange (IEX) has experienced significant revenue growth in recent years, driven by various market dynamics and strategic initiatives. Here are the key factors contributing to IEX’s robust performance:

1. Rising Power Demand

India’s electricity consumption is on a steep upward trajectory, fueled by:

- Economic Growth: A projected GDP growth rate of around 7% is expected to drive industrial activity and energy consumption, leading to increased demand for electricity across sectors such as manufacturing, electric vehicles (EVs), and data centers.

- Urbanization: The rapid urbanization and rising living standards are creating a higher demand for electricity, appliances, and transportation fuels.

2. Record Trading Volumes

IEX has consistently achieved record trading volumes, which directly impacts its revenue:

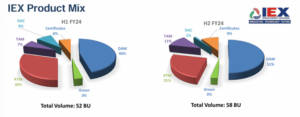

- In FY24, IEX surpassed the 100 billion unit (BU) mark for the first time, reaching 110 BU, representing a 13.8% year-on-year increase. This included a 12% surge in electricity trading volume to 101.7 BU.

- The first quarter of FY25 saw total trading volumes rise by 21% year-on-year, with significant contributions from both electricity and renewable energy certificates (RECs) trading.

3. Government Initiatives and Funding

The Indian government has increased its focus on the power sector:

- The 2024 budget allocated significantly more funding to initiatives aimed at promoting renewable energy sources like solar power and green hydrogen, which supports IEX’s growth in these segments.

- The government’s target of achieving 50% non-fossil fuel-based electricity generation capacity by 2030 presents substantial opportunities for IEX to expand its operations in renewable energy markets.

4. Diversification of Products and Services

IEX is actively expanding its product offerings:

- The introduction of new market segments such as the Green Real-Time Market (RTM) aims to capitalize on the growing demand for renewable energy.

- Plans for peer-to-peer trading models and long-duration contracts are set to enhance flexibility and attract more participants to the exchange.

5. Strong Market Position and Leadership

IEX maintains a dominant position in the market:

- With an estimated market share of around 83-84% in the power trading segment, IEX is well-positioned to leverage its leadership status to capture more market opportunities as demand grows.

- The company’s strategic initiatives, such as liquidity infusion schemes and transparent price discovery mechanisms, foster competition and enhance its appeal among consumers.

6. Focus on Renewable Energy

The shift towards sustainability is a critical driver:

- IEX has facilitated the trade of a significant number of renewable energy certificates (RECs), with a 26% increase in REC trading noted recently. This reflects the growing commitment to clean energy solutions.

- The Green Market segment has shown remarkable growth, with volumes increasing by over 250% year-on-year, highlighting the increasing interest in renewable energy trading.

Comparison of IEX’s Stock Performance with Industry Peers

The Indian Energy Exchange (IEX) has shown notable stock performance in comparison to its industry peers within the power trading sector. Here’s a detailed analysis of how IEX stacks up against its competitors, particularly in terms of recent performance, financial metrics, and market positioning.

Recent Stock Performance

- IEX Performance:

- Current Price: Approximately ₹216.88 (as of September 24, 2024).

- 1-Day Change: Increased by 3.24% on September 23, outperforming the Sensex, which rose by 0.38%.

- 1-Month Change: Up by 26.46%, significantly higher than the Sensex’s 4.66% increase.

- 52-Week High: Reached ₹238.90, indicating strong upward momentum.

- Peer Comparison:

- NTPC Limited:

- Current Price: ₹401.40

- P/E Ratio: 18.18

- Market Cap: ₹389,224 crore

- Recent Performance: Slight decline of 0.85%.

- Power Grid Corporation:

- Current Price: ₹337.25

- P/E Ratio: 19.98

- Market Cap: ₹313,663 crore

- Recent Performance: Decreased by 0.28%.

-

Financial Metrics

Metric IEX NTPC Power Grid Corp Current Price ₹216.88 ₹401.40 ₹337.25 Market Cap (₹ Cr) 19,534 389,224 313,663 P/E Ratio 52.53 18.18 19.98 Return on Equity (ROE) 36.08% 12.95% 17.87% Dividend Yield 1.14% 1.46% 1.42% Market Position and Growth Potential

- IEX commands a substantial market share in the power trading sector, controlling approximately 94% of the overall market and nearly 99% in specific segments like Day Ahead Market (DAM) and Real-Time Market (RTM).

- The exchange has seen a significant increase in trading volumes, with a record total volume of 13,250 MU in July 2024, marking a year-over-year increase of 56%.

- The recent surge in IEX’s stock price is attributed to its strong growth trajectory and the increasing demand for efficient power trading platforms as India’s energy consumption is expected to rise significantly in the coming years.

How does IEX’s market share in the energy sector compare to its competitors

IEX’s Market Share in the Energy Sector Compared to Competitors

The Indian Energy Exchange (IEX) is the leading player in India’s energy trading market, with a substantial market share that sets it apart from its competitors. Here’s a detailed comparison of IEX’s market share against its primary competitors in the energy sector.

Current Market Share of IEX

- Overall Market Share: IEX controls approximately 94.2% of the total energy trading market in India.

- Day Ahead Market (DAM): IEX dominates this segment with a commanding share of 99.9%.

- Real-Time Market (RTM): Similarly, it holds a 99.9% share in RTM.

- Green Market: The market share for green energy trading stands at about 3%.

- Total Average Market (TAM): IEX has a 14% share in this category, which includes various contracts and products.

Competitors in the Energy Trading Space

- Power Exchange India Limited (PXIL):

- Established as one of the two main competitors to IEX, PXIL has struggled to gain significant traction in the market.

- It holds a minor share compared to IEX, primarily focusing on niche segments like renewable energy certificates and some trading contracts.

- Himachal Pradesh Power Exchange (HPX):

- Launched in July 2022, HPX is the newest entrant in the power exchange market.

- While it aims to capture a portion of the market, its current share remains negligible compared to IEX’s dominance.

Competitive Landscape

The competitive landscape for energy trading in India is characterized by:

- Limited Competition: With IEX holding such a large market share, the competitive pressure from PXIL and HPX is minimal. This dominance allows IEX to set pricing trends and maintain liquidity across its trading platforms.

- Regulatory Environment: The Central Electricity Regulatory Commission (CERC) oversees power exchanges, and regulatory changes can impact how these exchanges operate. IEX has been proactive in adapting to these changes, further solidifying its position.

Conclusion

IEX’s overwhelming market share of over 94% positions it as a leader in India’s energy trading sector, particularly in key markets like DAM and RTM where it holds nearly complete control. In contrast, competitors like PXIL and HPX have yet to make significant inroads into this space. The combination of strong regulatory support, increasing electricity demand, and strategic initiatives will likely continue to bolster IEX’s position as the dominant player in India’s evolving energy landscape.

- NTPC Limited:

Discover more from

Subscribe to get the latest posts sent to your email.