Gold Prices Today: Latest Trends and Insights for September 7, 2024

As of September 7, 2024, gold prices in India continue to reflect the dynamic interplay of global economic factors and local market conditions. With ongoing geopolitical tensions and fluctuations in the U.S. economy, gold remains a key asset for investors seeking stability amidst uncertainty.

Current Gold Prices

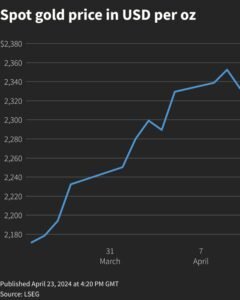

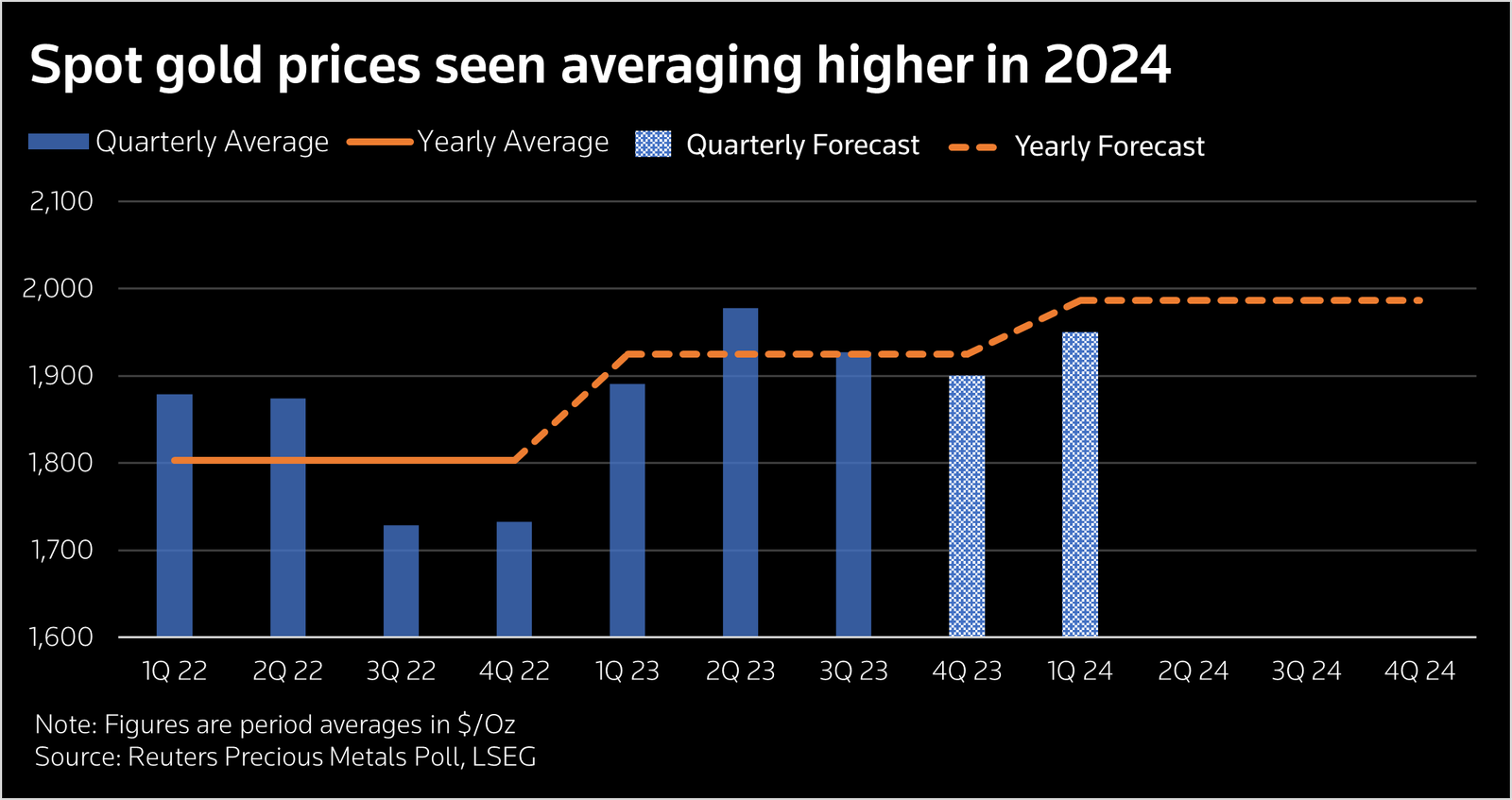

- Gold Price per Ounce: As of the latest updates, gold is trading at approximately $2,492.76 per ounce. This marks a slight decrease of 0.52% from the previous day but represents a significant increase of over 20% since the beginning of 2024.

- Gold Price in India: In Indian markets, the price for 22-carat gold is around ₹59,500 per 10 grams, while 24-carat gold is priced at approximately ₹64,500 per 10 grams. These prices are subject to change based on market demand and international gold rates.

Market Trends and Influences

- Geopolitical Tensions: The ongoing conflicts in Ukraine and the Middle East have heightened gold’s appeal as a safe-haven asset. Investors are flocking to gold to hedge against potential market volatility caused by geopolitical uncertainties.

- U.S. Federal Reserve Policies: Recent economic data from the U.S. indicates a mixed outlook, with expectations of potential interest rate cuts by the Federal Reserve. As the Fed signals a dovish stance, the opportunity cost of holding gold decreases, making it more attractive for investors.

- Central Bank Demand: Central banks worldwide continue to increase their gold reserves, with reported net purchases doubling in July 2024. This trend underscores gold’s enduring status as a store of value amidst economic fluctuations.

Future Outlook

Analysts predict that gold prices may experience further volatility in the coming weeks, influenced by upcoming economic reports, particularly the U.S. jobs report. A weaker-than-expected report could bolster gold prices, while a stronger report may temper expectations for aggressive rate cuts, impacting gold’s appeal.

- Price Projections: Looking ahead, gold is expected to trade around $2,623.27 per ounce within the next 12 months, reflecting continued demand driven by both investment and jewelry sectors.

Conclusion

As of September 7, 2024, gold prices remain robust, driven by a confluence of global economic factors and persistent demand for safe-haven assets. Investors are advised to stay informed about market trends and geopolitical developments, as these will play a crucial role in shaping the future of gold prices. Whether you are a seasoned investor or a newcomer to the market, understanding these dynamics is essential for making informed decisions in your investment strategy.

Discover more from

Subscribe to get the latest posts sent to your email.