Gold Prices Today in India: What You Need to Know (September 30, 2024)

As of September 30, 2024, gold prices in India continue to reflect the dynamic nature of the global market. Understanding the current rates and trends is essential for both investors and consumers looking to make informed decisions regarding their gold purchases.

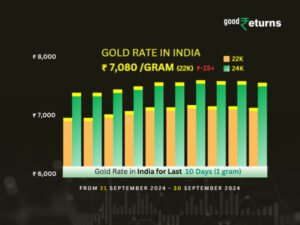

Current Gold Prices

On this date, the prices for gold in various cities across India are as follows:

- 24-Carat Gold:

- Delhi: ₹75,550 per 10 grams

- Mumbai: ₹75,440 per 10 grams

- Chennai: ₹74,500 per 10 grams

- Bengaluru: ₹75,650 per 10 grams

- 22-Carat Gold:

- Delhi: ₹71,950 per 10 grams

- Mumbai: ₹71,850 per 10 grams

- Chennai: ₹70,950 per 10 grams

- Bengaluru: ₹72,050 per 10 grams

These prices indicate a slight fluctuation compared to previous days, with gold witnessing a 0.08% decrease on September 27, closing at ₹75,340. However, it has shown a remarkable increase of 19.39% since the start of the year, reflecting the ongoing demand for gold as a safe investment during uncertain times.

Factors Influencing Gold Prices

Several factors influence gold prices in India:

- Global Market Trends: Fluctuations in international gold prices directly impact domestic rates. As global demand rises or falls due to economic conditions, so do local prices.

- Geopolitical Uncertainties: Events such as elections or conflicts can lead to increased demand for gold as a hedge against instability.

- Seasonal Demand: The festive season and wedding periods in India typically see a spike in gold purchases, further driving up prices.

- Currency Strength: The value of the Indian Rupee against the US Dollar also plays a crucial role; a weaker rupee makes gold more expensive.

Historical Context

Gold prices have been on an upward trajectory over the past year. For instance, comparing current rates to those from September last year reveals an increase of approximately 30.45%, highlighting gold’s role as a reliable investment amid inflationary pressures and economic uncertainty.

Investment Considerations

For those considering investing in gold:

- Long-Term vs. Short-Term: Assess whether you are looking for a long-term investment or short-term gains.

- Market Timing: Keep an eye on market trends and expert analyses to determine the best time to buy.

- Purity and Certification: Always ensure that you purchase certified gold from reputable dealers to avoid counterfeit products.

Conclusion

As of September 30, 2024, gold remains a valuable asset for investors and consumers alike. With current prices reflecting both global trends and local demand dynamics, staying informed about these fluctuations is essential for making sound financial decisions. Whether you are buying for personal use or investment purposes, understanding the market landscape will help you navigate your choices effectively.

Discover more from

Subscribe to get the latest posts sent to your email.