Gold Price Update: Current Trends and Insights

As of today, gold prices continue to reflect a complex interplay of global economic factors, geopolitical tensions, and market sentiment. Investors are closely monitoring these developments as they navigate the precious metals market.

Current Gold Prices in India

Today, gold prices in India are witnessing fluctuations due to various influencing factors. The price for 24K gold is around ₹73,000 per 10 grams, while 22K gold is priced at approximately ₹67,000 per 10 grams. These prices vary by city and are subject to local taxes and duties, which can significantly impact the final cost for consumers.

Key Factors Influencing Gold Prices

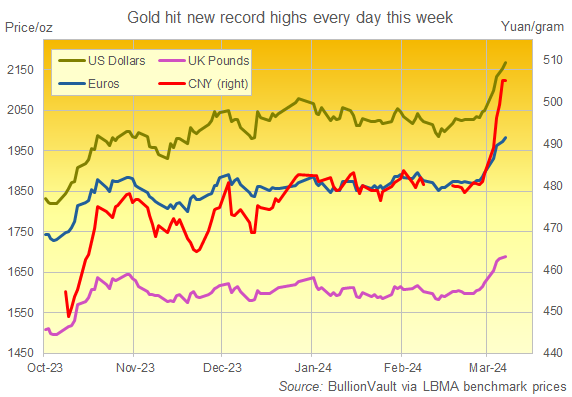

- Geopolitical Tensions: Ongoing conflicts, particularly in the Middle East, have heightened demand for gold as a safe haven asset. Recent escalations between Russia and Ukraine, alongside tensions involving Iran, have driven investors towards gold, pushing prices to record highs.

- Economic Data: Recent economic indicators from the U.S. show a mixed picture, with manufacturing activity declining and inflation pressures remaining. The Federal Reserve’s interest rate policies are also under scrutiny, as expectations for rate cuts could further influence gold prices. Markets are currently pricing in potential cuts, which typically bolster gold demand due to lower opportunity costs associated with holding non-yielding assets.

- Central Bank Purchases: Central banks globally have been increasing their gold reserves, with significant purchases noted in 2023. This trend supports higher gold prices as central banks diversify their reserves away from traditional currencies.

Market Sentiment and Future Outlook

The sentiment in the gold market remains bullish, with many analysts predicting that prices could rise further in the coming months. Factors such as seasonal demand during festivals in India and potential changes in import duties could also influence local prices. For instance, the recent reduction in customs duty has led to increased buying interest, particularly in the jewelry sector, which constitutes a significant portion of gold demand in India.

Conclusion

In summary, the current landscape for gold prices is shaped by a combination of geopolitical uncertainties, economic data releases, and central bank activities. Investors are advised to stay informed and consider these factors when making decisions related to gold investments. As the market evolves, keeping an eye on both local and global developments will be crucial for navigating the complexities of gold trading. This article synthesizes information from various sources to provide a clear and concise update on gold prices and market dynamics.

Discover more from

Subscribe to get the latest posts sent to your email.