Gold Price Today: Analyzing the Fluctuations and Factors Shaping the Market

As of September 12, 2024, gold prices in India continue to fluctuate, reflecting a complex interplay of global economic factors, domestic demand, and market sentiment. With the price of 24-carat gold hovering around ₹71,350 per 10 grams, understanding the underlying reasons for these fluctuations is crucial for investors and consumers alike.

Current Gold Prices

- 24-Carat Gold Price: ₹71,350 per 10 grams

- 22-Carat Gold Price: ₹67,950 per 10 grams

These prices indicate a slight decrease from the previous day, where 24-carat gold was priced at ₹71,450. Such daily variations are common in the gold market and can be attributed to several influencing factors.

Key Factors Influencing Gold Prices

- Global Economic Conditions: Gold is often viewed as a safe-haven asset during times of economic uncertainty. Recent global economic trends, including inflation rates, interest rates, and geopolitical tensions, significantly impact gold prices. For instance, the ongoing concerns about inflation have led many investors to turn to gold as a hedge, driving prices up when economic conditions are unstable.

- Monetary Policy and Interest Rates: The relationship between gold prices and interest rates is typically inverse. When interest rates rise, the opportunity cost of holding non-yielding assets like gold increases, leading to lower demand and consequently lower prices. Conversely, when rates fall, gold becomes more attractive, often resulting in price increases. Recent predictions suggest that the U.S. Federal Reserve may implement rate cuts, which could bolster gold prices further.

- Demand and Supply Dynamics: The demand for gold in India, particularly during festive seasons and weddings, plays a crucial role in price determination. The Indian market is one of the largest consumers of gold, and seasonal spikes in demand can lead to significant price increases. For example, upcoming festivals such as Dhanteras and Diwali typically see a surge in gold purchases, impacting overall market prices.

- Currency Fluctuations: Gold is traded internationally in U.S. dollars, meaning that fluctuations in the dollar’s strength can directly affect gold prices in India. A weaker dollar generally leads to higher gold prices, while a stronger dollar can suppress them. Recent trends have shown fluctuations in the dollar’s value, which have contributed to the volatility in gold prices.

- Geopolitical Risks: Events such as political unrest, conflicts, and trade tensions can create uncertainty in the markets, prompting investors to flock to gold. Geopolitical risks have been particularly pronounced in recent years, influencing gold’s status as a safe-haven asset.

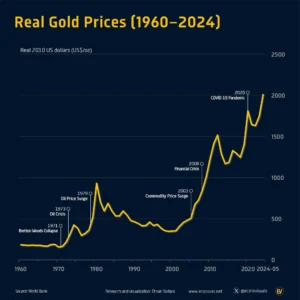

Historical Context of Gold Prices

Historically, gold prices have experienced significant fluctuations. In the early 2010s, prices peaked at around $1,900 per ounce due to the global financial crisis. Following a period of decline, gold reached an all-time high of over $2,070 per ounce in August 2020 amid the COVID-19 pandemic. Currently, gold prices are on an upward trajectory, reflecting ongoing economic uncertainties and inflationary pressures.

Conclusion

The fluctuations in gold prices are driven by a myriad of factors, including global economic conditions, interest rates, demand and supply dynamics, currency fluctuations, and geopolitical risks. As gold continues to be a vital asset in investment portfolios, understanding these factors is essential for making informed decisions. With the current gold price in India at ₹71,350 per 10 grams, investors should remain vigilant and consider both domestic and international developments that could influence future price movements.