Current Gold Rates in India: A Comprehensive Update for October 8, 2024

As of October 8, 2024, gold prices in India are experiencing notable fluctuations influenced by various global and local factors. Here’s a detailed overview of the current rates, market trends, and insights.

Current Gold Prices

- 24-Carat Gold: ₹7,612 per gram

- 22-Carat Gold: ₹6,976 per gram

| City | 22-Carat Gold Rate | 24-Carat Gold Rate |

|---|---|---|

| Delhi | ₹71,340 | ₹77,810 |

| Mumbai | ₹71,190 | ₹77,660 |

| Kolkata | ₹71,190 | ₹77,660 |

| Chennai | ₹71,340 | ₹77,810 |

| Bengaluru | ₹71,190 | ₹77,660 |

Note: Prices may vary slightly based on local jewellers and do not include GST.

Market Trends and Influences

- Geopolitical Tensions: Recent geopolitical instability in regions like West Asia has led to increased demand for gold as a safe haven asset. This has contributed to a rise in prices as investors seek security during uncertain times.

- Festive Season Demand: With the festive season underway in India, including Navratri and upcoming Dussehra and Diwali celebrations, gold purchases typically surge. This seasonal demand often drives prices higher as consumers flock to buy gold for rituals and gifts.

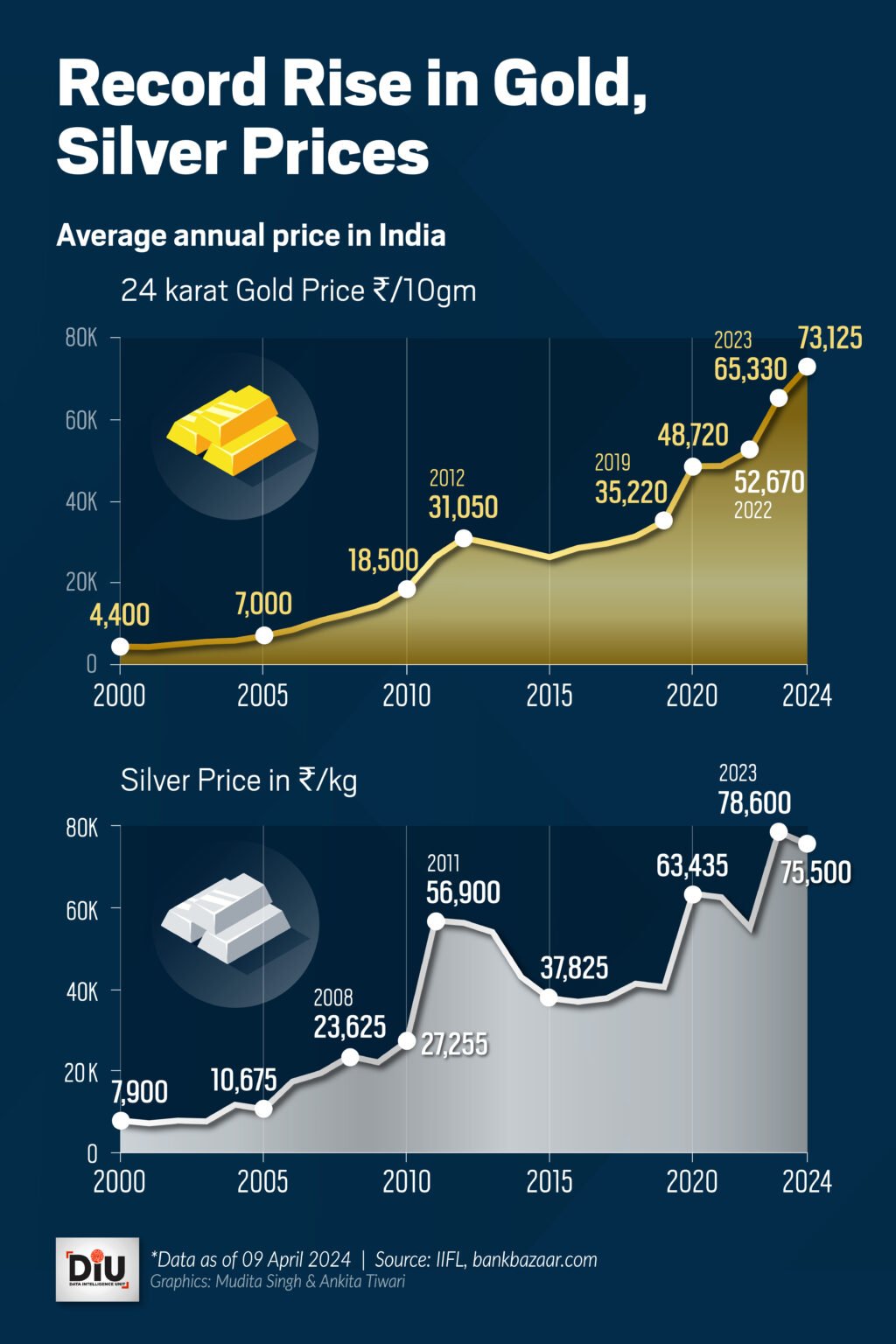

- Historical Price Levels: Current rates are among the highest recorded in Indian markets. As of October 4, 2024, the price of gold reached ₹76,190 per 10 grams on the MCX, indicating a significant increase over the past weeks.

- Investment Trends: There has been a noticeable uptick in investments in gold ETFs (Exchange-Traded Funds), reflecting a growing interest among investors looking for tax-efficient ways to invest without the need for physical storage. Inflows into gold ETFs reached approximately ₹1,337.4 crore in July 2024 alone.

- Global Economic Factors: The strength of the US dollar and international economic conditions continue to impact gold prices globally. Analysts suggest that any shifts in these factors could lead to corrections in gold prices in the near future.

Conclusion

The current landscape for gold prices in India is shaped by a combination of seasonal demand and external economic pressures. As we move further into the festive season, it’s essential for both consumers and investors to stay informed about market trends and potential price fluctuations.For those looking to purchase gold or invest during this period, it may be wise to monitor these developments closely and consider market conditions before making decisions.

Discover more from

Subscribe to get the latest posts sent to your email.