Gold Price Update: Today’s Rates and Trends in India

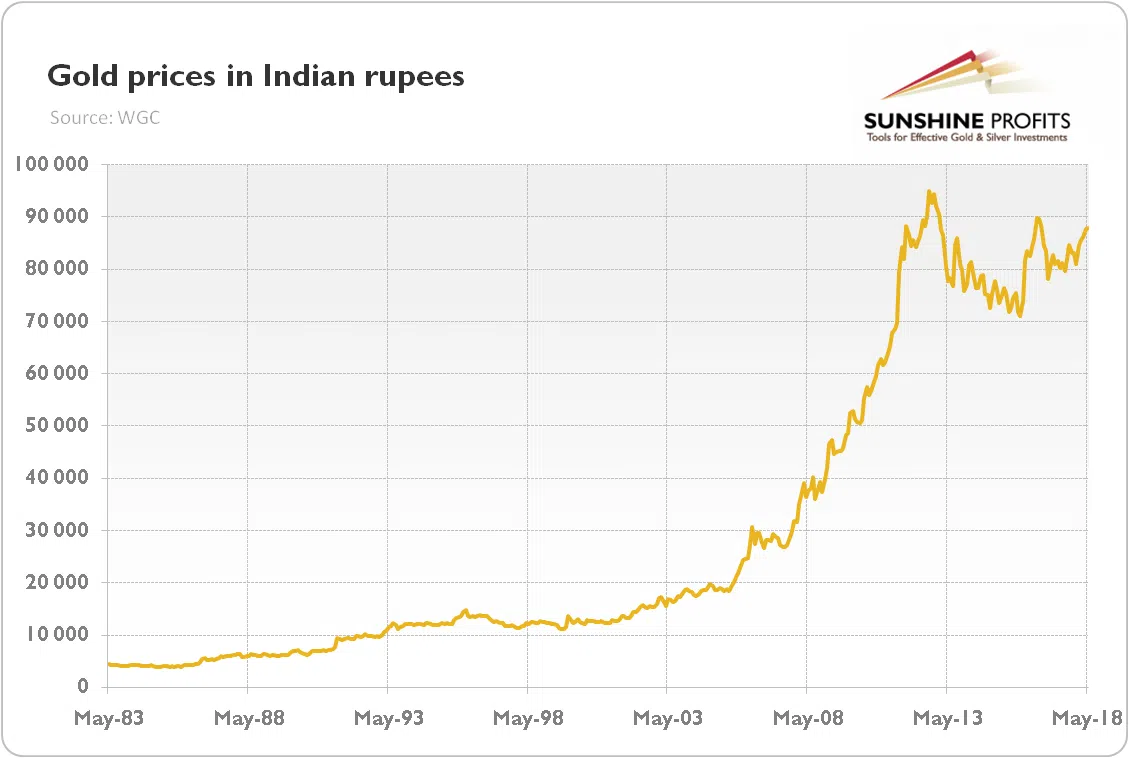

Gold has always been a significant asset in India, cherished not only for its beauty but also as a reliable investment. As we navigate through September 3, 2024, it’s essential to stay updated on the latest gold prices and the factors influencing these rates.

Current Gold Prices in India

As of today, the gold prices in India are as follows:

- 24 Karat Gold: ₹71,510 per 10 grams

- 22 Karat Gold: ₹65,500 per 10 grams

These rates are indicative and may vary slightly based on local market conditions and dealer premiums.

Factors Influencing Gold Prices

Gold prices are influenced by a myriad of factors, both domestic and international. Here are some key elements that contribute to the fluctuations:

- Global Market Trends: The prices of gold are significantly affected by trading activity in major markets such as the London Over-the-Counter (OTC) spot market and the COMEX futures market. Global economic conditions, including inflation rates and currency fluctuations, play a vital role.

- Demand and Supply Dynamics: In India, gold demand typically surges during festive seasons and weddings, which can drive prices higher. Conversely, a dip in demand can lead to price corrections.

- Currency Strength: The value of the Indian Rupee against the US Dollar is crucial. A weaker Rupee makes gold more expensive for Indian buyers, thereby pushing prices up.

- Interest Rates: Higher interest rates in the US and other countries can lead to a decrease in gold prices as investors may prefer interest-bearing assets.

- Geopolitical Factors: Political instability or conflicts can lead to increased demand for gold as a safe-haven asset, influencing prices upward.

Investment Options in Gold

Investing in gold can take various forms, each with its advantages:

- Physical Gold: This includes gold jewelry, coins, and bars. While physical gold is tangible, it involves additional costs such as making charges and storage.

- Gold ETFs: Exchange-Traded Funds (ETFs) allow investors to buy gold in a more liquid form without the need for physical storage. They are traded on stock exchanges and can be a cost-effective way to invest in gold.

- Gold Mutual Funds: These funds invest in gold bullion and gold-related securities. They offer a way to invest in gold without directly purchasing it, making them suitable for investors looking for convenience.

Conclusion

Today’s gold prices reflect a dynamic market influenced by various global and local factors. Whether you are looking to invest or purchase gold for personal use, understanding these trends can help you make informed decisions. As the market continues to evolve, staying updated on gold prices will ensure that you can seize the right opportunities in this precious metal.

Discover more from

Subscribe to get the latest posts sent to your email.