Ratan Naval Tata Passes Away: Over 20 years as chairman, Ratan Tata took charge of group as nation opened economy.

Ratan Naval Tata Passes Away: Ratan Naval Tata, chairman emeritus of Tata Sons, a beacon of India Inc who steered his group amid India’s economic liberalisation and, subsequently, guided its global expansion, breathed his last at Breach Candy Hospital in Mumbai Wednesday night.

Tata, 86, was admitted following age-related health issues and was undergoing treatment at the hospital.

Announcing his passing away, Tata Sons chairperson N Chandrasekaran, in a statement, said: “It is with a profound sense of loss that we bid farewell to Mr. Ratan Naval Tata, a truly uncommon leader whose immeasurable contributions have shaped not only the Tata Group but also the very fabric of our nation… On behalf of the entire Tata family, I extend our deepest condolences to his loved ones. His legacy will continue to inspire us as we strive to uphold the principles he so passionately championed.”

Conferred with the Padma Vibhushan, Tata was considered one of the biggest philanthropists in the country whose benevolence touched lives of millions through his work in the field of healthcare, education, drinking water and many other areas.

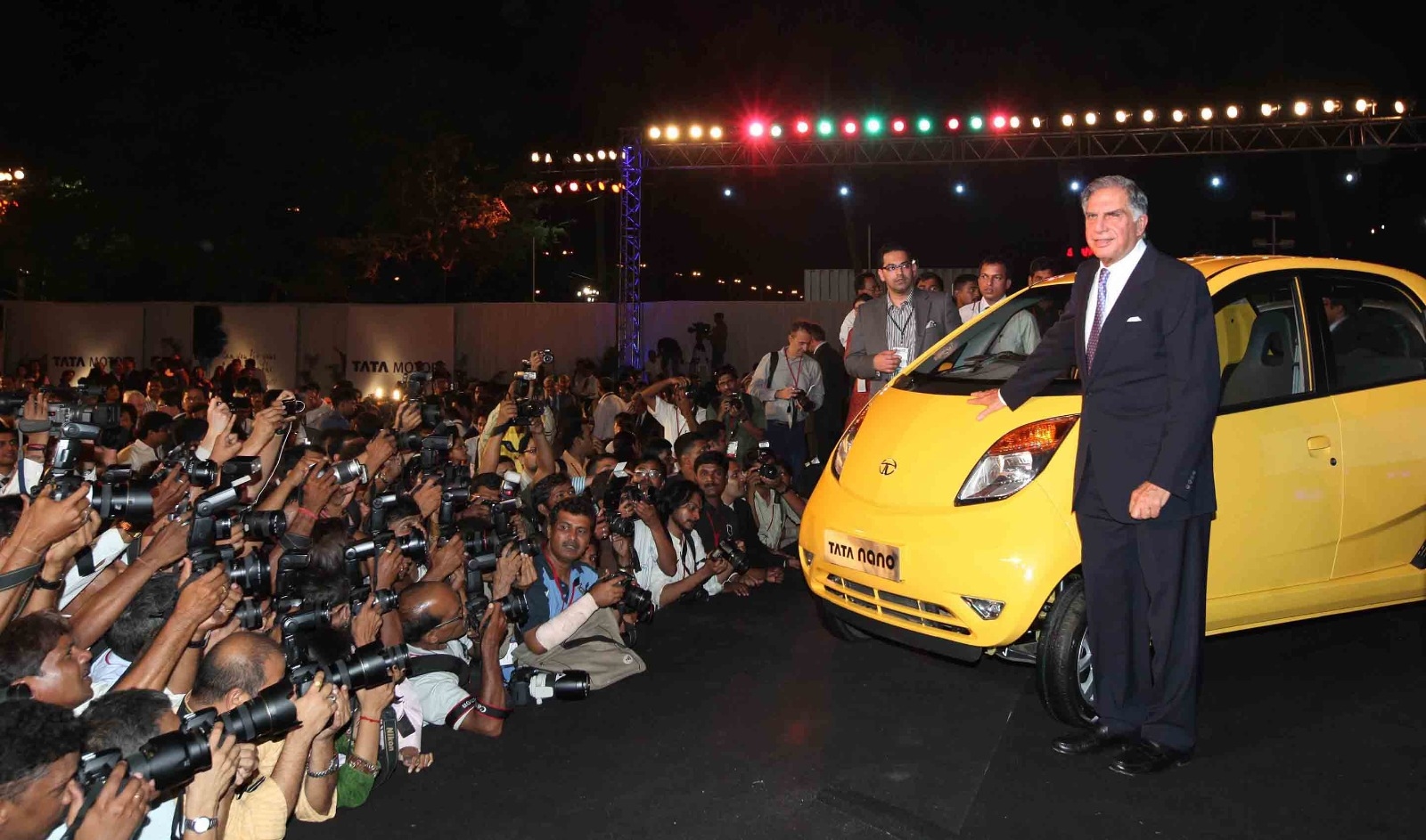

Ratan Tata at Nano launch at Parsi Gymkhana

Tata took over as Chairman of Tata Sons in 1991 from his uncle, the legendary JRD Tata, and was at the centre of many a battle in Bombay House, the headquarters of the Tata group. The pugnacious Tata took on satraps who considered their companies as their personal fiefdoms and showed them the door one after another.

JRD Tata who headed Tata Sons, the holding company of the group, from 1938 until 1991, allowed people like Russi Mody to come up in Tata Steel, Darbari Seth in Tata Chemicals and Tata Tea and Ajit Kerkar in Indian Hotels. JRD never interfered in the operations of these satraps who, in turn, thought they would manage their companies in their way.

Ratan Tata, after the takeover, was keen to bring more cohesiveness into the group, increase the Tata stake in group companies, strengthen the Tata brand and expand through organic and inorganic routes.

Ratan Tata poses next to the new Direct Injection Common Rail (DICOR) version Indica vehicle, at it’s launch at the 9th Auto Expo in New Delhi. (PTI)

Ratan Tata poses next to the new Direct Injection Common Rail (DICOR) version Indica vehicle, at it’s launch at the 9th Auto Expo in New Delhi. (PTI)

Mody put up a tough fight to retain control over Tata Steel as its Chairman and MD. Tata Sons, led by Ratan Tata, introduced the group’s forgotten retirement policy that directors who had crossed 75 would have to resign from Tata boards. Mody had to go.

The next was Darbari Seth, who was close to JRD but was uncomfortable with Ratan Tata. He had to leave Tata Chemicals and Tata Tea as per the retirement policy but he managed to get his son Manu Seth as MD of Tata Chemicals. He also resigned later.

However, Ajit Kerkar, who was running Indian Hotels put up some resistance and the retirement policy did not work here as Kerkar had a few more years to go. The Tatas had to ease him out.

In 2011, Tata Sons reduced the retirement age of non-executive directors from 75 years to 70, thus cutting short the work life of half a dozen Tata Group veterans who would now make space for comparatively younger corporate bureaucrats in the group’s boardrooms.

Global acquisitions, domestic expansion

After taking full control, Tata led from the front in globalisation of Indian business houses in the early 2000s. The first was Tata Tea’s acquisition of Tetley in 2000. Tata then went on an acquisition spree buying as many as three dozen small and big companies. Then came Tata Steel’s takeover of Anglo-Dutch steel maker Corus; and the British automobile marquee Jaguar and Land Rover by Tata Motors from Ford Motors.

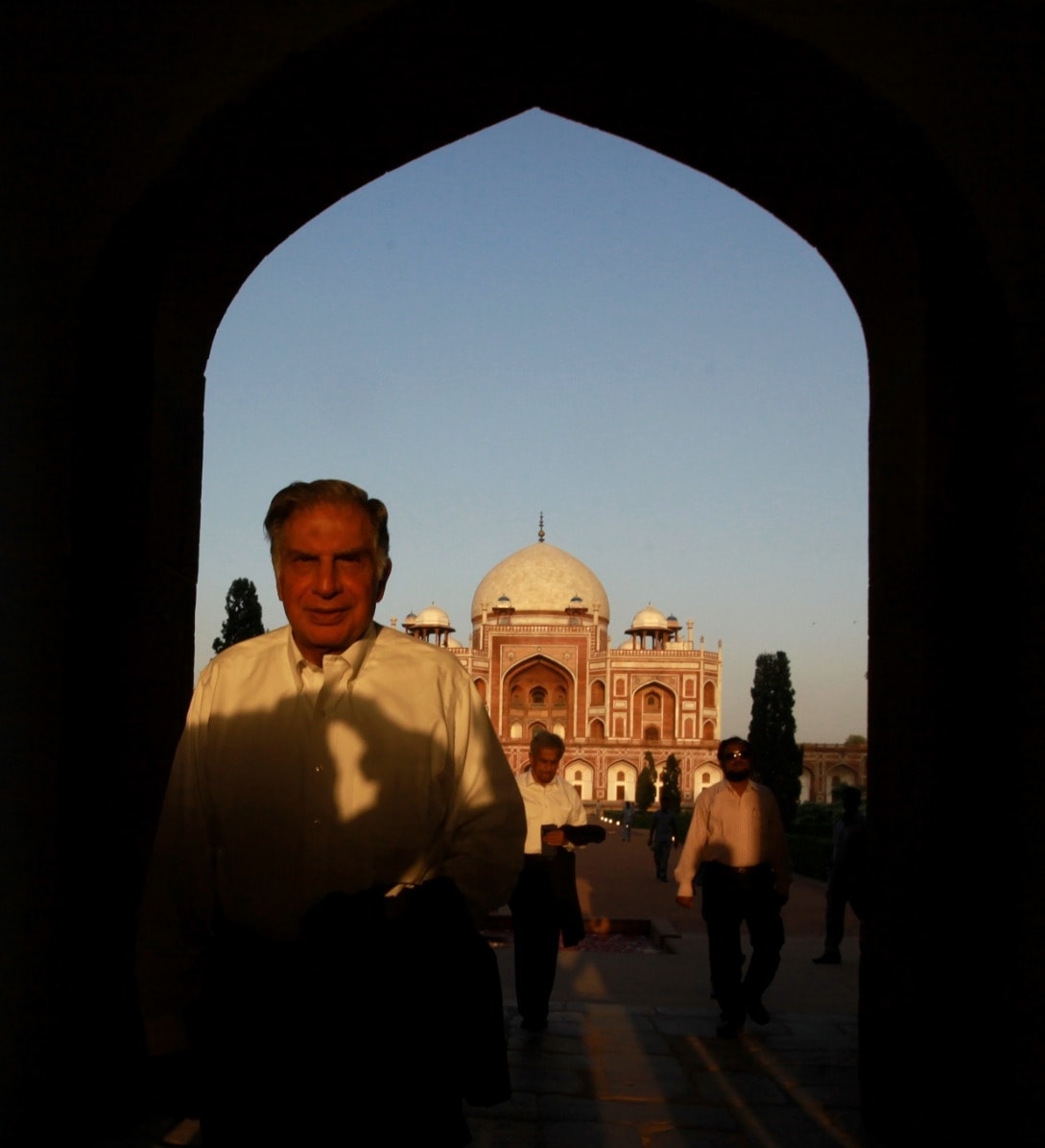

Ratan Tata during the Inauguration of Humayu’s Tomb after the Conservation on 18th Sept. 2013.

However, the group’s Corus acquisition ran into rough weather while JLR became profitable. “Acquisition of Corus was a mistake. Not an intentional one but an aspirational mistake,” former Tata Steel Managing Director JJ Irani once said.

The integration of Jaguar and Land Rover in the consolidated books of Tata Motors was achieved and the company has not looked back since then.

On the domestic front, Tata consolidated his group’s stake in various companies. In Tata Steel, the Birlas had more stake than Tata Steel once upon a time. However, Tata Sons increased its stake to 33.19 per cent in the steel maker. Various group companies went in for expansion and acquisition and the group’s turnover and market capitalisation rose over the years.

Hillary Clinton along with Ratan Tata and Mukesh Ambani at the business meet at Hotel Taj Mahal.

Hillary Clinton along with Ratan Tata and Mukesh Ambani at the business meet at Hotel Taj Mahal.

Tata Motors, which was earlier known as a commercial vehicle maker, started manufacturing passenger cars during his tenure. Tata took the initiative for the TCS listing on the stock exchange in 2004 which eventually became the second most valuable company on the bourses.

Mistry era

When Ratan Tata turned 75, he quit as the Chairman of Tata Sons in 2012. In mid-2012, Cyrus Mistry of the Pallonji Mistry group was chosen by a selection panel to head the Tata Group and took charge in December that year. Mistry was the chairman of the group from 2012 to 2016.

He was the sixth chairman of the group, and only the second after Nowroji Saklatwala to not bear the surname Tata. The Pallonji group, which is involved in the construction business, was associated with the Tatas for several decades.

However, things took a turn for the worse and Mistry’s relationship with Tata soured on various issues like expansion and diversification.

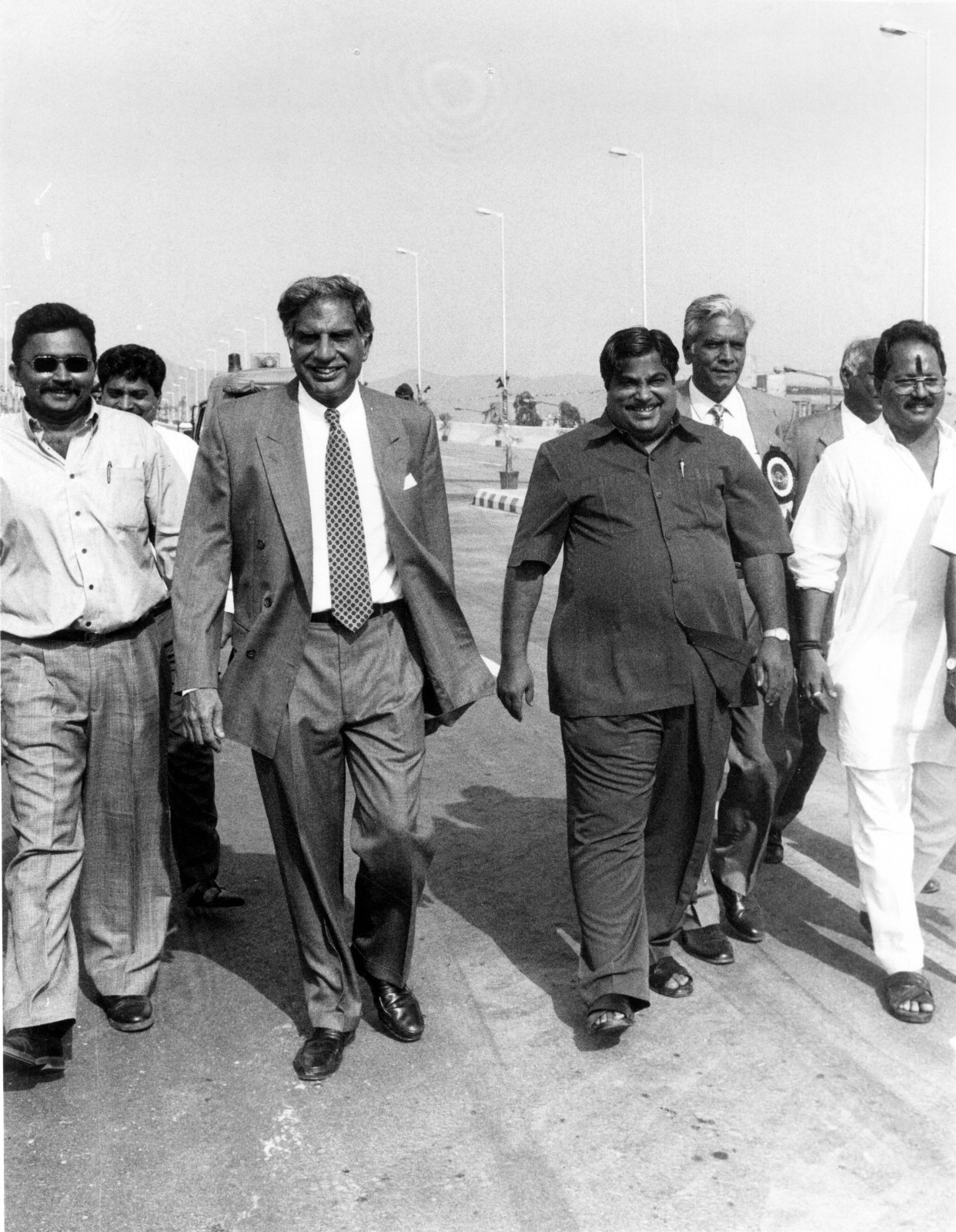

Industrialist Ratan Tata, Political leader Nitin Gadkari and Anant Tare at Vashi bridge inauguration on 22.04.99.*

Industrialist Ratan Tata, Political leader Nitin Gadkari and Anant Tare at Vashi bridge inauguration on 22.04.99.*

On October 24, 2016, the board of Tata Sons removed Mistry as the Chairman of Tata Sons. Ratan Tata, whom Mistry had replaced on December 29, 2012, was appointed as interim chairman for four months during which a search committee will scout for a replacement.

Mistry had raised a series of serious allegations against the overall functioning of the group, “total lack of corporate governance” and “the failure on the part of the directors to discharge the fiduciary duty owed to the stakeholders of the group”. This was stoutly rejected by the Tata group.

The Mistry family holds over 18 per cent stake in Tata Sons while the Tata Trusts, headed by Ratan Tata, controls 66 per cent stake. Both the sides – the Tatas and Mistrys – exchanged allegations. Mistry was also removed as Chairman of several companies, including TCS, Tata Steel, Tata Teleservices and Tata Industries.

Chandrasekaran era

After the exit of Cyrus Mistry, N Chandrasekaran, who made his mark as MD and CEO of TCS, was selected as the next Chairman of Tata Sons with the blessings of Ratan Tata. There were several other candidates but Chandrasekaran was selected as he had spent three decades with the Tatas and proved his mettle with the growth of TCS, the largest software company in India.

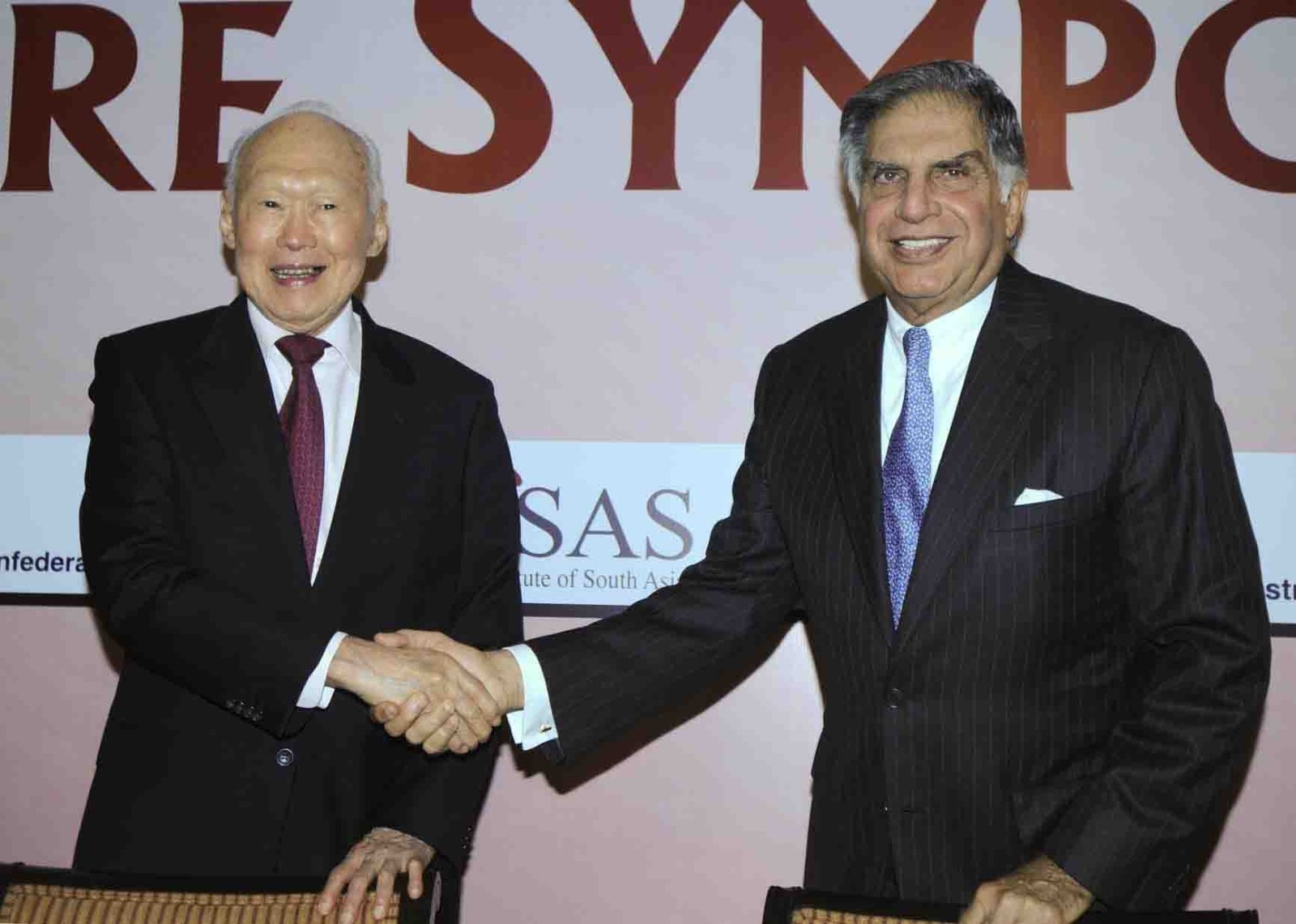

Lee Kuan Yew, Minister Mentor- Singapore with Ratan Tata at the ”Singapore Symposium” in New Delhi on wednesday.

He joined the Board of Tata Sons in October 2016 and was appointed Chairman in January 2017. He also chairs the Boards of several group operating companies, including Tata Steel, Tata Motors, Tata Power, Air India, Tata Chemicals, Tata Consumer Products, Indian Hotel Company, and Tata Consultancy Services.

Ratan Tata was the Chairman of Tata Trusts (comprising Sir Ratan Tata Trust and Allied Trusts, and the Sir Dorabji Tata Trust and Allied Trusts). As the Trusts own about 66 per cent stake in Tata Sons, the holding company of Tata group companies, Tata wielded considerable influence in the affairs of the Tata group.

Effective December 29, 2012, Tata was conferred the honorary title of Chairman Emeritus of Tata Sons, Tata Industries, Tata Motors, Tata Steel and Tata Chemicals.

After retirement, Ratan Tata was involved in RNT Capital, an investment platform, which invested in several startups like Lenskart, Bluestone, Ola Electric, Tork Motors and Urban Company.

PM Modi described Tata as a “visionary business leader, a compassionate soul, and an extraordinary human being.”

The beginning

Tata, born on December 28, 1937, joined the Tata group in 1962. After serving in various companies, he was appointed Director-in-Charge of the National Radio and Electronics Company in 1971. In 1981, he was named Chairman of Tata Industries, the group’s other holding company, where he was responsible for transforming it into a group strategy think tank and a promoter of new ventures in high-technology businesses.

Tata was the Chairman of the major Tata companies, including Tata Motors, Tata Steel, Tata Consultancy Services, Tata Power, Tata Global Beverages, Tata Chemicals, Indian Hotels and Tata Teleservices and during his tenure, the group’s revenues grew manifold.

Tata served on the international advisory boards of Mitsubishi Corporation and JP Morgan Chase. He was the Chairman of the Tata Trusts which are amongst India’s oldest, non-sectarian philanthropic organizations that work in several areas of community development. He was also the Chairman of the Council of Management of the Tata Institute of Fundamental Research and also served on the board of trustees of Cornell University and the University of Southern California.

Tata received an undergraduate degree in architecture from Cornell University in 1962. He worked briefly with Jones and Emmons in Los Angeles before returning to India in late 1962. He completed the Advanced Management Program at Harvard Business School in 1975.

Discover more from

Subscribe to get the latest posts sent to your email.