Analyzing Kalyan Jewellers’ Stock Performance: A Deep Dive into Recent Trends

Kalyan Jewellers India Ltd. has emerged as a significant player in the Indian jewelry market, and its stock performance has garnered considerable attention from investors and analysts alike. With a remarkable rise in share price over the past few years, the company is now at a pivotal point in its growth trajectory. This article delves into the recent trends in Kalyan Jewellers’ stock performance, highlighting key metrics, market sentiments, and future prospects.

Current Stock Overview

As of September 12, 2024, Kalyan Jewellers’ share price stood at approximately ₹689.30, reflecting a 4.95% increase from previous trading sessions. The stock has shown impressive growth, with a 164.26% increase over the past year and an astonishing 877.28% rise over the last three years. This upward trend positions Kalyan Jewellers as one of the standout performers in the consumer durable sector.

Key Financial Metrics

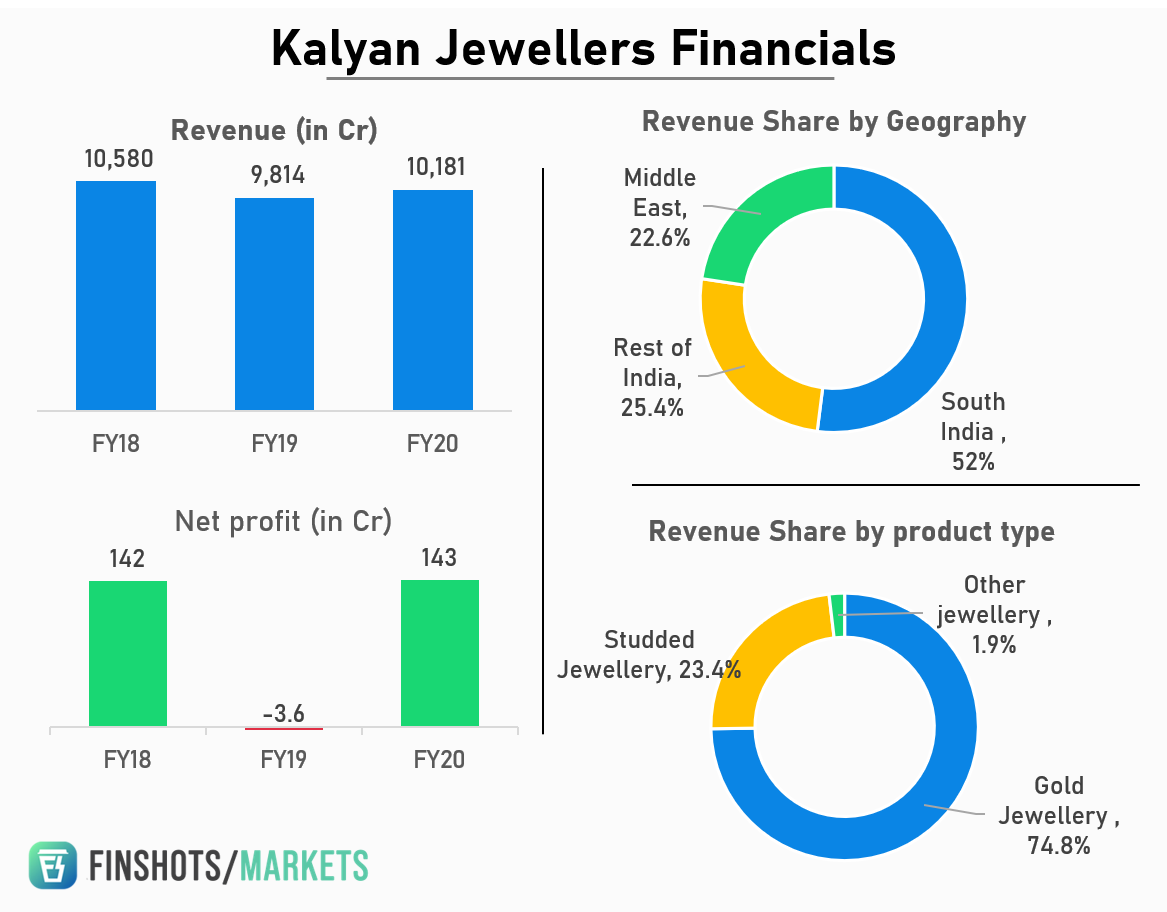

- Market Capitalization: Kalyan Jewellers boasts a market cap of around ₹63,403 crore, indicating its substantial presence in the jewelry industry.

- Price-to-Earnings (P/E) Ratio: The current P/E ratio is approximately 100.45, which is high compared to industry standards but reflects investor confidence in the company’s growth potential.

- Return on Equity (ROE): The company reported an ROE of 14.25%, outperforming its five-year average of 8.79%, suggesting improved profitability and efficient use of equity.

- Debt-to-Equity Ratio: Kalyan maintains a healthy debt-to-equity ratio of 0.83, indicating a balanced approach to leveraging and financial stability.

- Revenue Growth: The company has demonstrated a strong revenue growth rate of 31.82%, with net profits increasing by 38.30% in recent quarters, showcasing its robust operational performance.

Recent Developments and Market Sentiment

The stock’s recent performance has been buoyed by several positive developments:

- HSBC’s Buy Rating: HSBC recently upgraded Kalyan Jewellers’ stock to a “Buy” rating, citing a target price increase from ₹600 to ₹810. The brokerage highlighted Kalyan’s potential for continued growth, particularly through its capital-light expansion strategy.

- Expansion Plans: Kalyan Jewellers is poised to expand its store network significantly, with the potential to quadruple its current count of 217 stores. This expansion is expected to drive revenue growth and enhance market penetration, positioning Kalyan as a formidable competitor against established players like Titan.

- Market Positioning: Kalyan has established itself as a national brand, which differentiates it from regional competitors. Its aspirational yet value-driven positioning makes it less susceptible to market disruptions, allowing it to capture a larger share of the organized jewelry market.

Challenges Ahead

Despite the positive outlook, Kalyan Jewellers faces challenges that could impact its stock performance:

- High Valuation Metrics: The elevated P/E ratio suggests that the stock may be overvalued compared to historical averages, which could deter some conservative investors.

- Market Volatility: The jewelry sector can be sensitive to fluctuations in gold prices and consumer spending patterns, which may affect Kalyan’s profitability in the short term.

Conclusion

Kalyan Jewellers’ stock performance reflects a compelling growth story, driven by strong financial metrics, strategic expansion plans, and positive market sentiment. As the company continues to navigate the competitive landscape of the jewelry industry, investors are keenly watching its progress. With HSBC’s bullish outlook and the potential for significant market expansion, Kalyan Jewellers appears well-positioned for future growth. However, investors should remain cautious of the inherent risks associated with high valuations and market volatility.As Kalyan Jewellers embarks on this exciting phase, it will be essential to monitor its financial performance and strategic decisions closely, as these will ultimately shape its long-term success in the market.

Discover more from

Subscribe to get the latest posts sent to your email.